EXPECTED PRODUCTION GROWTH OF 15-35%

CAPITAL SPENDING OF US$1.2 BILLION

2011 OPERATIONS UPDATE

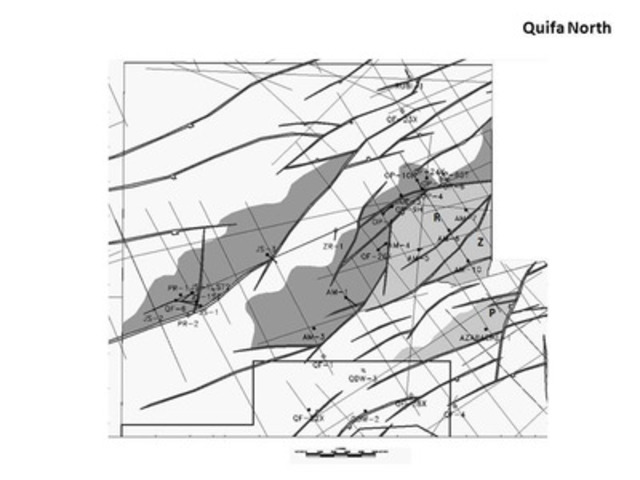

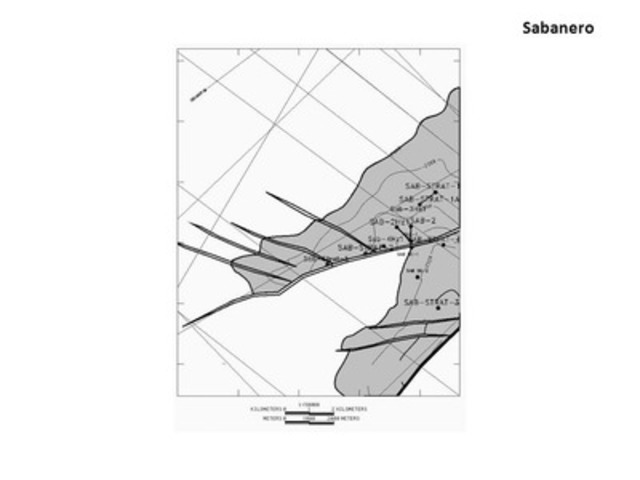

TORONTO, Jan. 9, 2012 /CNW/ - Pacific Rubiales Energy Corp. (TSX: PRE; BVC: PREC) announced today its capital spending plans for 2012, and an operations update to end 2011. The Company is expected to achieve average net after royalties production of approximately 86 Mboe/d in 2011, an increase of 51% over 2010 production, and exit the year at gross total field production of approximately 251 Mboe/d. The exit production is at the low end of the guidance range of 250-260 Mboe/d due to slower than expected commissioning at Quifa Norte and Sabanero, but the exit production in the two fields was 3.7 Mbbl/d and is expected to increase significantly in 2012. The Company expects 15-35% production growth in 2012, while the Company's capital spending will be relatively unchanged at US$1.2 billion. The Company operates approximately 60% of its aggregate capital project spending in 2012 and over 95% of its production.

Capital spending in 2012 is focused on: (1) expanding the Company's production in its flagship Rubiales/Piriri and Quifa SW oil fields; (2) growing production at the newly commissioned Quifa Norte and Sabanero oil blocks; (3) advancing its CPE-6 property toward commercial oil production; and (4) continuing drilling and seismic activities on its extensive high impact exploration portfolio in Colombia, Peru and Guatemala.

Highlights of the 2012 program include:

- Expected production growth of 15-35% against an estimated 86 Mboe/d net produced in 2011, largely driven by increased production in the Quifa, Sabanero and Rubiales heavy oil fields. Essentially all the expected production growth will be oil.

- Total capital expenditures of US$1.2 billion, a small increase over 2011, with exploration accounting for approximately 30% of the total budget. The capital program is expected to be entirely funded from internally generated funds and cash on hand in an expected oil price environment between US$80 - US$90 WTI.

- Exploration expenditures of US$340 million, a similar level to 2011, drilling approximately 60 gross wells (32 net) and seismic data acquisition. Significant exploration and appraisal drilling is planned for the Quifa Norte, Sabanero, CPE-6, and CPO-12 heavy oil blocks. In the total drill program, approximately 14 gross (9 net) exploration wells are targeting high impact prospects, including the Company's first well in Peru.

- US$285 million drilling a planned 285 gross (150 net) development wells, a significant increase over 2011, with activity driven by development of the Quifa SW field and the Quifa Norte and Sabanero blocks, and on-going infill drilling at Rubiales/Piriri.

- US$560 million facilities expenditure, with approximately 40% directed to Quifa, 30% to Rubiales/Piriri, and the remainder to Sabanero, with provision for advance and early progress on CPE-6.

Mr. Ronald Pantin, Chief Executive Officer, commented: "Pacific Rubiales enters the year in a very solid financial standing and is well positioned for another year of strong production growth. Total capital spending is expected to be similar to 2011, maintaining capital discipline in an uncertain commodity price environment and unstable global financial climate. Approximately 70% of capital spending will be directed to development drilling and facilities, designed to grow both production and reserves. The Company's ability to grow production at double digit rates for the fourth year in a row is underpinned by its large acreage position along the Colombia heavy oil resource trend and its execution and technical expertise. Exploration expenditure will be maintained at similar levels as in 2011, directed towards the Company's large portfolio of prospects, providing growth opportunities for both the medium and long term."

Management will hold a live conference call in English with simultaneous Spanish translation on Tuesday, January 10, 2012, beginning at 9:00 a.m. (Toronto/Bogotá time) to discuss the Company's 2012 Outlook & Guidance and provide an operational update to year-end 2011.

Analysts and interested investors are invited to participate as follows:

| Participant Number (International/Local): | (647) 427-7450 |

| Participant Number (Toll free Colombia): | 01-800-518-0661 |

| Participant Number (Toll free North America): | 1-888-231-8191 |

| Conference ID (English Participants): | 40671074 |

| Conference ID (Spanish Participants): | 40686485 |

The conference call will be webcast which can be accessed through the following link: http://www.pacificrubiales.com.co/investor-relations/webcast.html.

A replay of the call will be available until 23:59 p.m. (Toronto/Bogota time), January 24, 2012, which can be accessed as follows:

| Encore Toll Free Dial-in Number: | 1-855-859-2056 |

| Encore Local Dial-in-Number: | 416-849-0833 514-807-9274 403-451-9481 613-667-0035 778-371-8506 902-455-3955 |

Colombia

Colombia will remain the predominant focus of the Company's activities and expenditures in 2012.

In the Rubiales/Piriri oil fields, the Company plans on drilling approximately 160 development wells (65 net) aimed at optimizing development of its 2P reserves. Gross total field production is expected to increase to 200 Mbbl/d by the end of the year. Additional capital expenditures in the order of US$178 million will be directed to expanding the oil and water handling capacity of the fields.

In the Quifa field area, the Company plans on drilling approximately 120 development wells (84 net). The Quifa SW region of the field is in full development phase, while Quifa Norte also has active exploration with an additional 13 exploration and appraisal wells planned during the year aimed at extending the field and adding reserves. Exploration capital expenditure at Quifa will be approximately US$36 million, including drilling and seismic acquisition. Quifa gross total field production (including Quifa SW and Quifa Norte) is expected to increase to approximately 65 Mbbl/d by year-end (approximately 30 Mbbl/d net). Much of the growth will be provided by new production coming on stream in the Quifa Norte area. An estimated US$209 million in capital expenditures will be directed to new processing facilities at Quifa Norte and expanding facilities in Quifa SW.

At Sabanero, exploration and development activities will continue, with the drilling of 8 gross (4 net) development wells and 12 gross (6 net) exploration and appraisal wells. Total gross field production at the Sabanero block operated by Maurel et Prom Colombia B.V. ("Maurel et Prom") is expected to increase to approximately 15 Mbbl/d (6 Mbbl/d net) by year-end. Sabanero expenditures of approximately US$57 million include US$14 million in exploration capital in 2012. The Company indirectly owns a 49.999% interest in Maurel et Prom.

On the Company operated CPE-6 E&P block, located along the heavy oil trend some 70 km southwest of Rubiales/Quifa, the Company plans an active program of drilling and seismic data acquisition aimed at delineating earlier discoveries and advancing the block toward commercial development during the year. Pending partner approval and ongoing results at least 8 gross (4 net) exploration and appraisal wells and 365 km2 3D and 390 km 2D seismic are planned for the block during 2012. The Company's planned capital expenditure of US$66 million includes a provision for development facilities dependent on a mid-year commercial declaration and regulatory permits allowing for early production start-up.

In Colombia, in addition to Quifa, CPE-6 and Sabanero, exploration expenditures of approximately US$200 million will be directed to the drilling of 22 gross (13 net) exploration wells (including appraisal and stratigraphic wells), and seismic data acquisition. This includes high impact exploration wells planned for the CPO-1, CPE-1, CR-1, CPO-12, COR-15, SSJN-7, SSJN-9, Muisca, and Guama blocks, drilling on previously identified prospects. A large scale seismic data acquisition program totaling 1,300 kilometers is planned for the Tacacho, Terecay and PUT-9 blocks in the Putumayo basin directed at delineating prospects for drilling in 2013/2014.

Peru and Guatemala

The Company plans exploration capital spending of US$33 million in Peru during 2012. Expenditures include US$10 million for seismic data acquisition on block 135 and an estimated US$23 million to drill the first well on block 138, where the Company has a 55% operated interest.

Exploration expenditure of approximately US$15 million is planned for Guatemala in 2012, directed to seismic data acquisition aimed at delineating prospects for drilling in 2013.

2011 Operations Update

During the fourth quarter of 2011, the Company continued its active exploration drilling activity in the Quifa, Sabanero, La Creciente, Guama, Topoyaco and Arauca blocks, and also commenced drilling in the CPE-6 E&P block, for an estimated total of 18 gross (10 net) wells drilled (see attached table). The Company also started 2D and 3D seismic surveys on the CPO-1, CPO-12, Muisca, SSJN-7 and CR-1 blocks, aimed at defining drill prospects on these high potential exploration blocks. Highlights for the quarter include:

- First production from the Quifa Norte area, with gross production reaching approximately 1.8 Mbbl/d at year-end. Exploration drilling continued in the northern portion of the block, with 9 gross (6.3 net) wells drilled including four exploration and five appraisal wells. Two of the exploration wells resulted in new discoveries which extend the prospectivity of the northern portion of the block to the east. These wells along with three vertical and two horizontal appraisal wells are currently under extended production testing. One of the exploration wells encountered uneconomic pay thickness.

- First oil production from the Sabanero block, with gross production reaching approximately 1.8 Mbbl/d at year-end. During the quarter, Maurel et Prom, the operator of the block, drilled three stratigraphic wells and one appraisal well, with all four wells encountering indicated oil pay. The appraisal well is the first horizontal well drilled on the block and along with an earlier drilled deviated well are on long term production tests. At year-end one stratigraphic well and two horizontal appraisal wells were drilling on the block.

- During the quarter the Company commenced a program to drill 6 gross (3 net) wide diameter stratigraphic into the previously discovered Hamaca prospect on CPE-6 E&P block and initiate environmental licencing for the entire block. Four of these wells encountered indicated net oil pay on logs and the remaining two wells were completing drilling operations in the first week in January and will be logged in the coming weeks.

- During the quarter the Company had active exploration on a number of other blocks. 3D seismic surveys are currently underway targeting heavy oil prospects on blocks CPO-1 and CPO-12, and a 2D seismic survey was completed and an additional 3D seismic program initiated on block COR-15. On the Arauca block, the Vaco-1X exploration well was not deemed prospective and was abandoned. On the Topoyaco block in the Putumayo basin, the Yaraqui-1 well completed drilling operations in the quarter but tests over indicated log pays resulted in uneconomic heavy oil flows and the well has been suspended. On the Muisca block, the Nemqueteba-1X exploration well was abandoned after failing to test hydrocarbons. At year-end, the Apamate-2X exploration well on the La Creciente block and the Cororra-1X exploration well on the Guama block were drilling.

- During the quarter, the gross capacity of the Oleoducto de Los Llanos ("ODL") pipeline was increased to 340 Mbbl/d (35% working interest held by the Company), construction progressed on the 240 Mbbl/d dilution facility at the ODL and OCENSA pipeline connect with start-up expected in 2012, and engineering and environmental permitting initiated for the ODL branch extension to connect with the new Oleoducto Bicentenario ("OBC") pipeline. Construction on the OBC pipeline started in October with the first phase of construction providing gross capacity of 120 Mbbl/d and is expected to be operational in the second half of 2012. The Company has a 32.88% non-operated interest in the multiphase OBC pipeline, which is strategic to the Company's plans to increase its production from the Llanos basin.

- The Company's Synchronized Thermal Additional Recovery Project ("STAR") project was initiated at a pilot test site in the Quifa SW field during the quarter. The STAR project is designed to test and demonstrate the feasibility of applying secondary thermal recovery to heavy oil accumulations on the Company's Colombia blocks. Phase one of the project consisting of well pad and equipment set-up and cold (primary) flow for calibration was initiated during the quarter and will continue through the first quarter of 2012. Phase two consisting of hot thermal (secondary) production induced from air and steam injection is expected to be initiated towards the end of the first quarter of 2012.

- During the quarter the Company sold approximately 70% of its oil sales volumes as Castilla crude blend at an estimated US$12.50 premium to WTI price, 10% as Vasconia blend at an estimated US$20.50 premium to WTI, and the remaining oil sales volumes in the local and Rubiales markets. These fourth quarter price realizations were almost 40% higher than the same period in 2010.

For the calendar year ending December 31, 2011, the Company participated in the drilling of an estimated 70 gross (41 net) exploration wells (including exploratory, appraisal and stratigraphic wells).

4Q 2011 Exploration Well Table

| 4Q 2011 Exploration Wells | ||||

| Well Name | Type | Block | Area / Field / Prospect | Results |

| Opalo-9HZ | Appraisal | Quifa | Quifa Norte - Prospect Q | Successful |

| Opalo-10HZ | Appraisal | Quifa | Quifa Norte - Prospect Q | Successful |

| Opalo-4 | Appraisal | Quifa | Quifa Norte - Prospect Q | Successful |

| Opalo-6 | Appraisal | Quifa | Quifa Norte - Prospect Q | Successful |

| Ambar-5 | Exploration | Quifa | Quifa Norte - Prospect F | Successful |

| Ambar-7 | Appraisal | Quifa | Quifa Norte - Prospect F | Successful |

| Ambar-10 | Exploration | Quifa | Quifa Norte - Prospect R | Successful |

| Azabache-1 | Exploration | Quifa | Quifa Norte - Prospect P | Successful |

| Rubi-1 | Exploration | Quifa | Quifa Norte - Prospect Y | Dry |

| Hamaca-1 | Stratigraphic | CPE-6 | CPE-6 E&P - Hamaca Prospect | Successful |

| Hamaca-2 | Stratigraphic | CPE-6 | CPE-6 E&P - Hamaca Prospect | Successful |

| Hamaca-3 | Stratigraphic | CPE-6 | CPE-6 E&P - Hamaca Prospect | Drilling |

| Hamaca-4 | Stratigraphic | CPE-6 | CPE-6 E&P - Hamaca Prospect | Drilling |

| Hamaca-5 | Stratigraphic | CPE-6 | CPE-6 E&P - Hamaca Prospect | Successful |

| Hamaca-6 | Stratigraphic | CPE-6 | CPE-6 E&P - Hamaca Prospect | Successful |

| SAB-STRAT-2 | Stratigraphic | Sabanero | Sabanero | Successful |

| SAB-STRAT-3 | Stratigraphic | Sabanero | Sabanero | Successful |

| SAB-STRAT-4 | Stratigraphic | Sabanero | Sabanero | Successful |

| SAB-STRAT-5 | Stratigraphic | Sabanero | Sabanero | Drilling |

| SAB-2HZ1 | Appraisal | Sabanero | Sabanero | Successful |

| SAB-3HZ1 | Appraisal | Sabanero | Sabanero | Drilling |

| SAB-4HZ1 | Appraisal | Sabanero | Sabanero | Drilling |

| Apamate-2X | Appraisal | La Creciente | Apamate Prospect | Drilling |

| Cotorra-1X | Exploration | Guama | Pedernalito Prospect | Drilling |

| Yaraqui-1X | Exploration | Topoyaco | Prospect D | Dry |

Pacific Rubiales, a Canadian-based company and producer of natural gas and heavy crude oil, owns 100 percent of Meta Petroleum Corp., a Colombian oil operator which operates the Rubiales and Piriri oil fields in the Llanos Basin in association with Ecopetrol, S.A., the Colombian national oil company, and 100 percent of Pacific Stratus Energy Corp. which operates the La Creciente natural gas field. The Company is focused on identifying opportunities primarily within the eastern Llanos Basin of Colombia as well as in other areas in Colombia and northern Peru. Pacific Rubiales has working interests in 46 blocks in Colombia, Peru and Guatemala.

The Company's common shares trade on the Toronto Stock Exchange and La Bolsa de Valores de Colombia under the ticker symbols PRE and PREC, respectively.

Advisories

Cautionary Note Concerning Forward-Looking Statements

This press release contains forward-looking statements. All statements, other than statements of historical fact, that address activities, events or developments that the company believes, expects or anticipates will or may occur in the future (including, without limitation, statements regarding estimates and/or assumptions in respect of production, revenue, cash flow and costs, reserve and resource estimates, potential resources and reserves and the company's exploration and development plans and objectives) are forward-looking statements. These forward-looking statements reflect the current expectations or beliefs of the company based on information currently available to the company. Forward-looking statements are subject to a number of risks and uncertainties that may cause the actual results of the company to differ materially from those discussed in the forward-looking statements, and even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on the company. Factors that could cause actual results or events to differ materially from current expectations include, among other things: uncertainty of estimates of capital and operating costs, production estimates and estimated economic return; the possibility that actual circumstances will differ from the estimates and assumptions; failure to establish estimated resources or reserves; fluctuations in petroleum prices and currency exchange rates; inflation; changes in equity markets; political developments in Colombia, Guatemala or Peru; changes to regulations affecting the company's activities; uncertainties relating to the availability and costs of financing needed in the future; the uncertainties involved in interpreting drilling results and other geological data; and the other risks disclosed under the heading "Risk Factors" and elsewhere in the company's annual information form dated March 11, 2011 filed on SEDAR at www.sedar.com. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Although the company believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.

In addition, reported production levels may not be reflective of sustainable production rates and future production rates may differ materially from the production rates reflected in this press release due to, among other factors, difficulties or interruptions encountered during the production of hydrocarbons.

Boe Conversion

Boe may be misleading, particularly if used in isolation. A boe conversion ratio of 5.7 Mcf: 1 bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. The estimated values disclosed in this news release do not represent fair market value. The estimates of reserves and future net revenue for individual properties may not reflect the same confidence level as estimates of reserves and future net revenue for all properties, due to the effects of aggregation.

| Paragraph Reference | Using Colombian Standard 5.7 Mcf:1 bbl | Using Canadian Standard 6 Mcf: 1 bbl |

| 1 and 3 | 86 Mboe | 85.3 Mboe |

| 1 | 251 Mboe | 250.3 Mboe |

Definitions

| bbl | Barrel of oil. |

| bbl/d | Barrel of oil per day. |

| boe | Barrel of oil equivalent. Boe's may be misleading, particularly if used in isolation. The Colombian standard is a boe conversion ratio of 5.7 Mcf:1 bbl and is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. |

| boe/d | Barrel of oil equivalent per day. |

| Mbbl | Thousand barrels. |

| Mboe | Thousand barrels of oil equivalent. |

| MMbbl | Million barrels. |

| Mcf | Thousand cubic feet. |

| WTI | West Texas Intermediate Crude Oil. |

Image with caption: "Quifa Norte Block Exploration Map (CNW Group/Pacific Rubiales Energy Corp.)". Image available at: http://photos.newswire.ca/images/download/20120109_C2756_PHOTO_EN_8724.jpg

Image with caption: "Sabanero Block Exploration Map (CNW Group/Pacific Rubiales Energy Corp.)". Image available at: http://photos.newswire.ca/images/download/20120109_C2756_PHOTO_EN_8725.jpg

Christopher (Chris) LeGallais

Sr. Vice President, Investor Relations

+1 (647) 295-3700

Ms. Carolina Escobar V

Corporate Manager Investor Relations

+57 (1) 628-3970