TORONTO, April 27, 2012 /CNW/ - Pacific Rubiales Energy Corp. (TSX: PRE) (BVC: PREC) (BOVESPA: PREB) announced today that it has reached an agreement with BPZ Resources, Inc. ("BPZ") (NYSE: BPZ) (BVL: BPZ) to enter into a series of transactions ultimately resulting in the acquisition of beneficial ownership of a 49% undivided participating interest (the "Participating Interest") in the Z-1 exploration and development block ("Block Z-1"), offshore in Peru. Under the terms of the agreement, Pacific Rubiales will pay U.S.$150 million in cash and is subject to a commitment of U.S.$185 million for BPZ's share of capital and exploratory expenditures in Block Z-1.

Once the Company has satisfied its commitment to BPZ in connection with the capital and exploratory expenditures, the partners will share costs at their respective ownership interest basis. Completion of the acquisition is subject to approval of the applicable Peruvian authorities.

Ronald Pantin, Chief Executive Officer of the Company, commented: "This is an exciting opportunity and an excellent fit with the Company's strategy of generating profitable growth and diversifying our exploration and production portfolio. The acquisition complements our existing exploration acreage in Peru, and it provides us with first production in the country. The size of the deal is very manageable and allows us to preserve a strong balance sheet and maintain capital spending flexibility. These are oil weighted assets with excellent running room to expand production, in a country that we see a lot of opportunity. We consider this to be an attractive deal for both companies."

The Acquisition

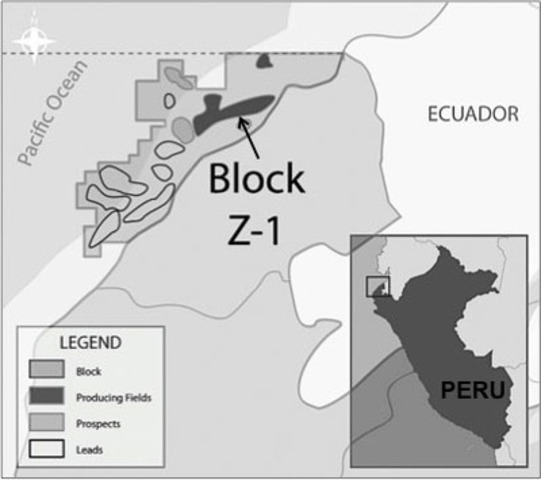

The Company believes that the assets underlying the Participating Interest are high quality with significant exploration and development upside. BPZ currently holds a 100% working interest and is operator under the license relating to the block. BPZ's acreage in Block Z-1 encompasses an area of approximately 555 thousand gross acres. The block is in the offshore Tumbes basin where oil and gas are trapped in Tertiary aged clastic reservoirs, in water depths ranging from 200 to 1,000 feet. The acquisition includes the developed and producing Corvina and Albacora oil fields, three undeveloped prospects (Piedra Redonda, Barracuda, Delfin), eight additional exploration leads; and existing production facilities, infrastructure and development projects.

Average production on Block Z-1 for the three months ended March 31, 2012 was approximately 3,880 bbl/d oil, all from the Corvina and Albacora fields. All oil is sold in the domestic markets at world reference prices. The current (year-end 2011) total proved ("1P") gross oil reserves on Block Z-1 was estimated by BPZ's independent reserves evaluators to be 34.7 MMbbl and total proved plus probable ("2P") gross oil reserves were 93.9 MMbbl.

There is considerable upside to current production expected from Block Z-1. Corvina also includes estimates of 190 Bcf of natural gas reserves, which are non-commercial at the present time. However, plans are being developed for a gas-to-power project to supply an initial 30 MMcf/d to an onshore electrical generating plant over a 20 year period, which Pacific Rubiales will have an opportunity to participate in. Three exploration prospects and eight leads on the block provide additional upside un-risked resource potential estimated at over 2 billion boe (approximately 50% oil), are expected to feed longer term growth. Exploration and development capital spending by the Company is expected to be funded by internally generated cash flow. For further information regarding Block Z-1, please see the news releases issued by BPZ on March 5, 2012 and June 16, 2011 available on their website at www.bpzenergy.com and BPZ's most recent SEC filings.

BPZ will remain the operator of the license, while Pacific Rubiales will assume the role of technical operations manager pursuant to an Operating Service Agreement. BPZ currently has an established technical and operational workforce in Peru which will be complemented by additional technical and managerial staff from Pacific Rubiales.

Strategic Context

Peru is a country with considerable O&G exploration and development potential, has an attractive and competitive fiscal regime, and encourages foreign investment. The transaction provides the Company with its first production and operating cash flow in Peru, offers development opportunities to expand production in the short and medium term, and complements our existing exploration acreage in the interior Maranon Basin of Peru.

The transaction is subject to the approval of the Peru regulatory authority. Bank of America Merrill Lynch and GMP Securities, L.P. acted as financial advisors to the Company on the transaction.

Pacific Rubiales, a Canadian-based company and producer of natural gas and heavy crude oil, owns 100 percent of Meta Petroleum Corp., a Colombian oil operator which operates the Rubiales, Piriri and Quifa oil fields in the Llanos Basin in association with Ecopetrol, S.A., the Colombian national oil company, and 100 percent of Pacific Stratus Energy Corp. which operates the La Creciente natural gas field. The Company is focused on identifying opportunities primarily within the eastern Llanos Basin of Colombia as well as in other areas in Colombia and northern Peru. Pacific Rubiales has working interests in 44 blocks in Colombia, Peru and Guatemala.

The Company's common shares trade on the Toronto Stock Exchange and La Bolsa de Valores de Colombia and as Brazilian Depositary Receipts on Brazil's Bolsa de Valores Mercadorias e Futuros under the ticker symbols PRE, PREC, and PREB, respectively.

BPZ Energy, which trades as BPZ Resources, Inc. on the New York Stock Exchange and the Bolsa de Valores de Lima, is an independent oil and gas exploration and production company with license contracts for exploration and production in four properties in Peru. In offshore Block Z-1, the Company is currently executing the development of the Corvina oil discovery, as well as redevelopment of the Albacora oil field. In addition, the Company seeks to develop onshore Blocks XIX, XXII and XXIII, in parallel with the execution of an integrated gas-to-power strategy, which includes generation and sale of electric power in Peru and the development of a regional gas marketing strategy. The Company also owns a non-operating net profits interest in a producing property in southwest Ecuador. Please visit the Company's website at www.bpzenergy.com for more information.

Advisories

Cautionary Note Concerning Forward-Looking Statements

This press release contains forward-looking statements. All statements, other than statements of historical fact, that address activities, events or developments that the company believes, expects or anticipates will or may occur in the future (including, without limitation, statements regarding estimates and/or assumptions in respect of production, revenue, cash flow and costs, reserve and resource estimates, potential resources and reserves and the company's exploration and development plans and objectives) are forward-looking statements. These forward-looking statements reflect the current expectations or beliefs of the company based on information currently available to the company. Forward-looking statements are subject to a number of risks and uncertainties that may cause the actual results of the company to differ materially from those discussed in the forward-looking statements, and even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on the company. Factors that could cause actual results or events to differ materially from current expectations include, among other things: uncertainty of estimates of capital and operating costs, production estimates and estimated economic return; the possibility that actual circumstances will differ from the estimates and assumptions; failure to establish estimated resources or reserves; fluctuations in petroleum prices and currency exchange rates; inflation; changes in equity markets; political developments in Colombia, Guatemala or Peru; changes to regulations affecting the company's activities; uncertainties relating to the availability and costs of financing needed in the future; the uncertainties involved in interpreting drilling results and other geological data; and the other risks disclosed under the heading "Risk Factors" and elsewhere in the company's annual information form dated March 14, 2012 filed on SEDAR at www.sedar.com. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Although the company believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.

In addition, reported production levels may not be reflective of sustainable production rates and future production rates may differ materially from the production rates reflected in this press release due to, among other factors, difficulties or interruptions encountered during the production of hydrocarbons.

Boe Conversion

Boe may be misleading, particularly if used in isolation. A boe conversion ratio of 5.7 Mcf: 1 bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. The estimated values disclosed in this news release do not represent fair market value. The estimates of reserves and future net revenue for individual properties may not reflect the same confidence level as estimates of reserves and future net revenue for all properties, due to the effects of aggregation.

Definitions

| Bcf | Billion cubic feet. |

| Bcfe | Billion cubic feet of natural gas equivalent. |

| bbl | Barrel of oil. |

| bbl/d | Barrel of oil per day. |

| boe | Barrel of oil equivalent. Boe's may be misleading, particularly if used in isolation. The Colombian standard is a boe conversion ratio of 5.7 Mcf:1 bbl and is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. |

| boe/d | Barrel of oil equivalent per day. |

| Mbbl | Thousand barrels. |

| Mboe | Thousand barrels of oil equivalent. |

| MMbbl | Million barrels. |

| MMboe | Million barrels of oil equivalent. |

| Mcf | Thousand cubic feet. |

| MMcf | Million cubic feet. |

| WTI | West Texas Intermediate Crude Oil. |

Image with caption: "Block Z-1 (CNW Group/Pacific Rubiales Energy Corp.)". Image available at: http://photos.newswire.ca/images/download/20120427_C9465_PHOTO_EN_12773.jpg

Christopher (Chris) LeGallais

Sr. Vice President, Investor Relations

+1 (647) 295-3700

Carolina Escobar V

Corporate Manager Investor Relations

+57 (1) 628-3970