TORONTO, May 22, 2012 /CNW/ - Pacific Rubiales Energy Corp. (TSX: PRE) (BVC: PREC) (BOVESPA: PREB) provided today a strategic and operational update relating to the results of the recent testing of the Triceratops-2 appraisal well where the Company holds a net 10% non-operated participating interest in the well drilling on Petroleum Prospective License 237 ("PPL-237"), onshore Papua New Guinea.

As announced earlier by the operator, InterOil Corporation (NYSE: IOC; POMSoX: IOC), the Triceratops-2 well reached total depth of 2,236 metres (7,334 ft) in the Lower Limestone, and a drill stem test ("DST") across a 228 meter (748 ft) open hole section in the upper reservoir zone tested 17.6 MMcf/d gas with a measured condensate liquids content of between 13.6 and 16.3 bbl per MMcf. Preliminary data from the test indicates that the upper reservoir zone in Triceratops-2 is pressure connected to the Bwata-1 well drilled 3.5 kilometers along trend and which tested gas flows up to 28 MMcf/d. The test rates from the Triceratops-2 well compare favourably with equivalent DST intervals in wells drilled on the Elk/Antelope structure along trend. The Elk/Antelope structure has independently certified best case contingent resources of 8.6 Tcf gas and 129 MMbbl condensate.

Ronald Pantin, Chief Executive Officer of the Company, commented: "This is a very exciting result and confirms our belief that the Triceratops structure and PPL-237, along with earlier discoveries by InterOil in the adjacent Elk/Antelope structure, indeed represents a world class gas and condensate trend and provides the Company with the strategic opportunity for early stage large resource capture on the doorstep of the world's fastest growing primary energy markets. Not only is the Triceratops structure in itself proving to be a new discovery of significant magnitude, but additional prospects and leads on the large PPL-237 block provide further potential resource upside."

The upper reservoir zone is underlain by an 80.5 meter (264 ft) marl and argillaceous limestone interval that likely acts as a seal separating it from an indicated lower reservoir zone. Wireline logs across this lower zone suggest a potential dolomitic reservoir. Gas shows encountered during drilling along with recovery of condensate in a DST across a 29 meter (96 ft) interval indicate potential movable hydrocarbons in the lower reservoir zone. The Triceratops-2 well did not encounter a gas-water contact ("GWC") despite drilling below the depth of a GWC identified in the adjacent Bwata-1 well, indicating that the lower reservoir zone is in a different compartment.

The Company's evaluation of all the well, petrophysical, test and seismic data to date, indicates a P50 structural closure of approximately 10,000 acres with net pay of 1,700 feet, and high quality reservoir with average porosities of 6% and water saturations of 20%, for the Triceratops structure.

InterOil has indicated that it will proceed with casing the well and a program of perforating and testing zones of interest including the indicated lower reservoir zone. Testing through casing is expected to yield more definitive results than those possible on limited DST's.

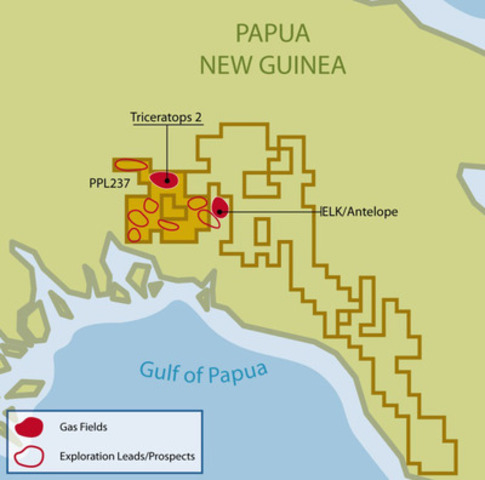

Below is a map showing location of PPL-237 and Triceratops structure, Papua New Guinea

Pacific Rubiales, a Canadian-based company and producer of natural gas and heavy crude oil, owns 100 percent of Meta Petroleum Corp., a Colombian oil operator which operates the Rubiales, Piriri and Quifa oil fields in the Llanos Basin in association with Ecopetrol, S.A., the Colombian national oil company, and 100 percent of Pacific Stratus Energy Corp. which operates the La Creciente natural gas field. The Company is focused on identifying opportunities primarily within the eastern Llanos Basin of Colombia as well as in other areas in Colombia and northern Peru. Pacific Rubiales has working interests in 43 blocks in Colombia, Peru and Guatemala.

The Company's common shares trade on the Toronto Stock Exchange and La Bolsa de Valores de Colombia and as Brazilian Depositary Receipts on Brazil's Bolsa de Valores Mercadorias e Futuros under the ticker symbols PRE, PREC, and PREB, respectively.

InterOil Corporation is developing a vertically integrated energy business whose primary focus is Papua New Guinea and the surrounding region. InterOil's assets consist of petroleum licenses covering about 3.9 million acres, an oil refinery, and commercial distribution facilities, all located in Papua New Guinea. In addition, InterOil is a shareholder in a joint venture established to construct liquefaction facilities in Papua New Guinea. InterOil's common shares trade on the NYSE in US dollars.

Advisories

Cautionary Note Concerning Forward-Looking Statements

This press release contains forward-looking statements. All statements, other than statements of historical fact, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future (including, without limitation, statements regarding estimates and/or assumptions in respect of production, revenue, cash flow and costs, reserve and resource estimates, potential resources and reserves and the Company's exploration and development plans and objectives) are forward-looking statements, including in particular, statements concerning the drilling of the Triceratops-2 well in the Triceratops fields, the characteristics of the Triceratops reef structure and business plans and strategies, the plans to obtain definitive test results from the lower reservoir section and InterOil's exploration plans, benefits to stakeholders and increased investment in Papua New Guinea. These forward-looking statements reflect the current expectations or beliefs of the Company based on information currently available to the Company. Forward-looking statements are subject to a number of risks and uncertainties that may cause the actual results of the Company to differ materially from those discussed in the forward-looking statements, and even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on, the Company. Factors that could cause actual results or events to differ materially from current expectations include, among other things: uncertainty of estimates of capital and operating costs, production estimates and estimated economic return; the possibility that actual circumstances will differ from the estimates and assumptions; failure to establish estimated resources or reserves; fluctuations in petroleum prices and currency exchange rates; inflation; changes in equity markets; political developments in Colombia, Guatemala or Peru; changes to regulations affecting the Company's activities; uncertainties relating to the availability and costs of financing needed in the future; the uncertainties involved in interpreting drilling results and other geological data; and the other risks disclosed under the heading "Risk Factors" and elsewhere in the Company's annual information form dated March 14, 2012 filed on SEDAR at www.sedar.com. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Although the Company believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.

In addition, reported production levels may not be reflective of sustainable production rates and future production rates may differ materially from the production rates reflected in this press release due to, among other factors, difficulties or interruptions encountered during the production of hydrocarbons.

Boe Conversion

Boe may be misleading, particularly if used in isolation. A boe conversion ratio of 5.7 Mcf: 1 bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. The estimated values disclosed in this news release do not represent fair market value. The estimates of reserves and future net revenue for individual properties may not reflect the same confidence level as estimates of reserves and future net revenue for all properties, due to the effects of aggregation.

Definitions

| Bcf | Billion cubic feet. |

| Bcfe | Billion cubic feet of natural gas equivalent. |

| bbl | Barrel of oil. |

| bbl/d | Barrel of oil per day. |

| boe | Barrel of oil equivalent. Boe's may be misleading, particularly if used in isolation. The Colombian standard is a boe conversion ratio of 5.7 Mcf:1 bbl and is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. |

| boe/d | Barrel of oil equivalent per day. |

| Mbbl | Thousand barrels. |

| Mboe | Thousand barrels of oil equivalent. |

| MMbbl | Million barrels. |

| MMboe | Million barrels of oil equivalent. |

| Mcf | Thousand cubic feet. |

| MMcf | Million cubic feet. |

| MMcf/d | Million cubic feet per day. |

| Tcf | Trillion cubic feet. |

| WTI | West Texas Intermediate Crude Oil. |

Image with caption: "Map showing location of PPL-237 and Triceratops structure, Papua New Guinea (CNW Group/Pacific Rubiales Energy Corp.)". Image available at: http://photos.newswire.ca/images/download/20120522_C9421_PHOTO_EN_13994.jpg

Christopher (Chris) LeGallais

Sr. Vice President, Investor Relations

+1 (647) 295-3700

Carolina Escobar V

Corporate Manager Investor Relations

+57 (1) 628-3970