TORONTO, Sept. 18, 2012 /CNW/ - Pacific Rubiales Energy Corp. (TSX: PRE; BVC: PREC; BOVESPA: PREB) announced today that it has reached an agreement with Karoon Gas Australia Ltd. (ASX: KAR) ("Karoon") to acquire a 35% net working interest in the following exploration blocks: S-M-1101, S-M-1102, S-M-1037 and S-M-1165, and also has as an option to acquire a 35% interest in S-M-1166 (collectively, the "Karoon Blocks"). In consideration for acquiring the interests in the Karoon Blocks, the Company will pay Karoon U.S.$40 million in cash as consideration for the assignment and fund up to U.S.$210 million in carried well costs.

Ronald Pantin, Chief Executive Officer of the Company, commented: "This acquisition will represent a significant step forward in our plans to transform the Company for the future. It is an exciting exploration opportunity, is an excellent fit with the Company's strategy to target large resource capture in high potential basins and positions us well to expand further into Brazil. With these new assets, Pacific Rubiales will increase its presence in South America and enter into one of the most prolific oil rich hydrocarbon basins in the western hemisphere, building on our successful technical and project management record."

The Acquisition

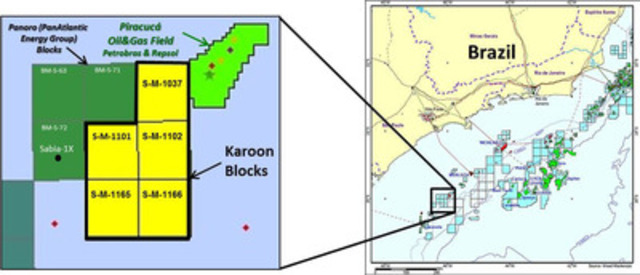

The Karoon Blocks are located 220 kilometers off the coast of Santa Catarina state, just south of Rio de Janeiro, in the Santos basin. The blocks lie in 300 - 400 m water depth, in an area with a number of existing or discovered oil and gas fields. The transaction is subject to the approval of the Agência Nacional do Petróleo, Gás Natural e Biocombustíveis ("ANP"), Brazil's oil and gas regulatory authority.

The transaction agreement consists of a U.S.$40 million payment to Karoon as consideration for the assignment, plus a carry of well costs of up to U.S.$70 million for each of the Kangaroo and Cassowary/Emu exploration wells for a total well carry cost of up to U.S.$140 million. After meeting up to the first U.S.$70 million costs for each of the first two wells, the Company will fund 35% of all costs thereafter.

The Company may elect to participate in the third well of the three well exploration commitment program, the Bilby well. If the option is exercised, Pacific Rubiales must carry up to the first U.S.$70 million in costs for the Bilby well and contribute 35% of all costs thereafter.

All three wells are expected to be drilled during 2013. Karoon will remain the operator of the Karoon Blocks until the completion of the three well exploration program and then Pacific Rubiales will be entitled to request the operatorship, subject to the Company meeting all regulatory and other legal requirements to the satisfaction of the ANP.

Strategic Context

Pacific Rubiales believes that it will acquire an interest in high quality exploration assets with a moderate risk but high reward profile, accessing large resources with the potential to develop into significant producing assets.

The Company has identified several multi-level post-salt and two pre-salt prospects on the Karoon Blocks. All of these prospects contain direct hydrocarbon indicators from seismic data. Management estimation of total P50 recoverable resources reached 1.8 billion boe excluding the pre-salt opportunities.

The Karoon Blocks lie along trend with the Piracucá and Caravela oil fields and the Merluza gas field. In April 2009, Petrobras/Repsol declared the BM-S-7 Piracucá light oil field a commercial discovery. The field is approximately five kilometers to the northeast of the Karoon acreage and is reported to contain 550 MMboe in place (Repsol, 2009). The Late Santonian reservoirs produced 3,476 bbl/d oil and liquids with approximately 4.4 MMcf/d gas in preliminary tests (Repsol, November 2009). Petrobras is currently considering an aggregate FPSO development for the field and other fields in the area. PanAtlantic Energy Group recently announced that its Sabia-1X exploration well drilled on block BM-S-72 just to the west of the Karoon Blocks, has penetrated multiple hydrocarbon bearing zones of interest, providing additional indications of the prospectivity of the area.

The Company sees Brazil as an area of untapped potential with a strong resource and reserve base. The United States Geological Survey (USGS) has estimated ("Assessment of Undiscovered Conventional Oil and Gas Resources of South America and the Caribbean, 2012") that the Campos and Santos Basins, located off the country's southeastern coast, have undiscovered oil resources in the range of 26 billion barrels (P95) to 65 billion barrels (P5).

According to the Oil and Gas Journal (OGJ), Brazil has 14 billion bbl of proven reserves in 2012, the second-largest in South America after Venezuela. The Campos and Santos Basins hold the vast majority of Brazil's proven reserves. In 2010, Brazil produced 2.7 MMbbl/d of oil and liquids.

Brazil is the ninth largest energy consumer in the world and the third largest in the Western Hemisphere, behind the United States and Canada. Total primary energy consumption in Brazil has increased by close to a third in the last decade, due to sustained economic growth. Increasing domestic oil production has been a long-term goal of the Brazilian government, and recent discoveries of large offshore, pre-salt oil fields could transform Brazil into one of the largest oil producers in the world.

Pacific Rubiales, a Canadian-based company and producer of natural gas and heavy crude oil, owns 100 percent of Meta Petroleum Corp., a Colombian oil operator which operates the Rubiales, Piriri and Quifa oil fields in the Llanos Basin in association with Ecopetrol, S.A., the Colombian national oil company, and 100 percent of Pacific Stratus Energy Corp. which operates the La Creciente natural gas field. The Company is focused on identifying opportunities primarily within the eastern Llanos Basin of Colombia as well as in other areas in Colombia and northern Peru.

The Company's common shares trade on the Toronto Stock Exchange and La Bolsa de Valores de Colombia and as Brazilian Depositary Receipts on Brazil's Bolsa de Valores Mercadorias e Futuros under the ticker symbols PRE, PREC, and PREB, respectively.

Karoon Gas Australia Ltd, an Australian Stock Exchange listed global energy exploration company, with highly prospective assets in Australia, Brazil and Peru. Karoon is currently in the midst of a two year exploration drilling program that is set to include a minimum of eleven wells in three independent basins. Currently the Phase II exploration campaign has commenced in the Browse Basin, Australia, with the goal to confirm the size and composition of the Greater Poseidon Trend ahead of development decision making. In the coming months, three exploration wells will commence in the Santos Basin, Brazil, with the goal of making new shallow water discoveries of hydrocarbons. During 2013, Karoon expects to commence drilling in Block Z-38 in the Tumbes Basin, Peru, with the goal of making new oil and gas discoveries.

Advisories

Cautionary Note Concerning Forward-Looking Statements

This press release contains forward-looking statements. All statements, other than statements of historical fact, that address activities, events or developments that the company believes, expects or anticipates will or may occur in the future (including, without limitation, statements regarding estimates and/or assumptions in respect of production, revenue, cash flow and costs, reserve and resource estimates, potential resources and reserves and the company's exploration and development plans and objectives) are forward-looking statements. These forward-looking statements reflect the current expectations or beliefs of the company based on information currently available to the company. Forward-looking statements are subject to a number of risks and uncertainties that may cause the actual results of the company to differ materially from those discussed in the forward-looking statements, and even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on the company. Factors that could cause actual results or events to differ materially from current expectations include, among other things: uncertainty of estimates of capital and operating costs, production estimates and estimated economic return; the possibility that actual circumstances will differ from the estimates and assumptions; failure to establish estimated resources or reserves; fluctuations in petroleum prices and currency exchange rates; inflation; changes in equity markets; political developments in Colombia, Guatemala or Peru; changes to regulations affecting the company's activities; uncertainties relating to the availability and costs of financing needed in the future; the uncertainties involved in interpreting drilling results and other geological data; and the other risks disclosed under the heading "Risk Factors" and elsewhere in the company's annual information form dated March 14, 2012 filed on SEDAR at www.sedar.com. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Although the company believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.

In addition, reported production levels may not be reflective of sustainable production rates and future production rates may differ materially from the production rates reflected in this press release due to, among other factors, difficulties or interruptions encountered during the production of hydrocarbons.

Definitions

| Bcf | Billion cubic feet. |

| Bcfe | Billion cubic feet of natural gas equivalent. |

| bbl | Barrel of oil. |

| bbl/d | Barrel of oil per day. |

| boe | Barrel of oil equivalent. Boe's may be misleading, particularly if used in isolation. The Colombian standard is a boe conversion ratio of 5.7 Mcf:1 bbl and is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. |

| boe/d | Barrel of oil equivalent per day. |

| Mbbl | Thousand barrels. |

| Mboe | Thousand barrels of oil equivalent. |

| MMbbl | Million barrels. |

| MMboe | Million barrels of oil equivalent. |

| Mcf | Thousand cubic feet. |

| WTI | West Texas Intermediate Crude Oil. |

Image with caption: "Map of the Karoon Blocks (CNW Group/Pacific Rubiales Energy Corp.)". Image available at: http://photos.newswire.ca/images/download/20120918_C6903_PHOTO_EN_18058.jpg

SOURCE: Pacific Rubiales Energy Corp.

Christopher (Chris) LeGallais

Sr. Vice President, Investor Relations

+1 (647) 295-3700

Roberto Puente

Sr. Manager, Investor Relations

+57 (1) 511-2298

Javier Rodriguez

Manager, Investor Relations

+57 (1) 511-2319